-

Bonds (Commerce Lesson)

Commerce

Inyang Umoh (tutor)

13-02-2016 18:15:00 +0000When a company, government or other major institution needs more cash, they have several choices. They may borrow money from a bank, sell stocks or seek other investors, but sometimes issue bonds.

Imagine a very successful pure water company called XYZ Water needs to expand their business to meet up with demand for their product.

They might issue bonds with the following terms.

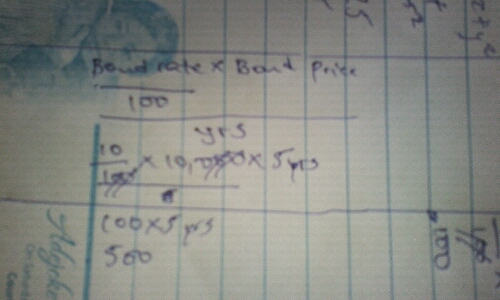

- Bond price: N1000 (this is also called principal)

- Bond rate: 10% (this is also called bond yield)

- Term: 5 years

This means that if you give XYZ Water 1000 today, you will receive 10% of your investment every year (N100 each year for 5 years).

In this scenario, you are the bond holder and XYZ Water is the bond issuer. The company receives your money and gives you a piece of paper called a bond certificate.

Lets say the company's expansion went so well that they feel they don't need your money any longer and they would like to pay you back early.

Callable bonds - If the bonds are callable they would pay you for the time that they had your money (N100 x 2 years) and you would return the bond certificate.

Irrevocable bonds - If the bonds are irrevocable, the company would be forced to honor the original agreement and continue paying dividends for the full 5 years.

When the 5 year period has been reached, the bond is said to be matured.

-

{[reply.name]}

{[reply.voteCount]} {[reply.voteCount]} {[reply.created]}

{[reply.voteCount]} {[reply.created]}